Wake County Property Information

Real Estate Wake County Government

Get information on what is taxed as real estate property and annual tax bills. Real estate property includes: - Land - Buildings - Structures - Improvements - Permanent fixtures - Mobile homes that are placed upon a permanent enclosed foundation on land owned by the owner of the mobile home.

https://www.wake.gov/departments-government/tax-administration/real-estate

Fiscal Year 2026 Adopted Budget Wake County Government

Wake County Commissioners adopt $2.1 billion budget for FY2026 The Wake County Board of Commissioners voted on June 2 to adopt a $2.1 billion budget for fiscal year 2026, which runs from July 1, 2025, to June 30, 2026. It will increase the County’s investment in the Wake County Public School System’s operating budget by $40.3 million, which matches the Board of Education’s funding request.

https://www.wake.gov/departments-government/budget-management-services/fiscal-year-2026-adopted-budget

Tax increase included in $2.1 billion Wake County budget ...

$2.1B budget that comes with property tax increase adopted in Wake County for fiscal year 2026. ByElaina Athans and Sean Coffey WTVD logo.

https://abc11.com/post/property-taxes-tax-increase-included-21-billion-wake-county-budget-is-heavy-funding-school-needs/16635707/iMAPS Information Wake County Government

Wake County GIS and Raleigh GIS developed the iMAPS online interactive mapping application to provide easy access to reliable property information. Users can look up properties by owner name, address, place of interest or intersection and retrieve a variety of maps and property information. Help pages are available to make iMAPS easy to use. See FAQs for help to improve iMAPS performance.

https://www.wake.gov/departments-government/geographic-information-services-gis/maps-apps-data/imaps-information

Moving to Raleigh in 2026? Watch this BEFORE You Buy a Home! - YouTube

NaN / NaN In this video Chapters Transcript Chapters Why Raleigh’s Market Feels Confusing Why Raleigh’s Market Feels Confusing 0:00 Is Raleigh Crashing or Booming? Is Raleigh Crashing or Booming? 1:05 The Two Raleigh Markets in 2026 The Two Raleigh Markets in 2026 2:00 The Silent Crash Under $500k The Silent Crash Under $500k 3:00 How Builders Are Beating Resale Homes How Builders Are Beating Resale Homes 4:05 Payment Math...

https://www.youtube.com/watch?v=jIACcx3yBj8

Property Tax Firms in North Carolina

... property tax appeals for all property types throughout Wake County ... Ryan, LLC. Please ensure Javascript is enabled for purposes of website accessibility.

https://ryan.com/practice-areas/property-tax/north-carolina/Property Tax - Forms NCDOR

A new tax on alternative nicotine products will also be imposed. Tax related to the rate change of product in inventory as of July 1 will apply. For more information, review the tobacco products page. The Department has issued a new notice titled, Eligibility for Listing in the North Carolina Department of Revenue Vapor Products and Consumable Products Directory.

https://www.ncdor.gov/taxes-forms/property-tax/property-tax-forms

2025 Property Tax Bills Wake County Government

The Wake County Board of Commissioners voted on June 2 to adopt a $2.1 billion budget for Fiscal Year 2026. It will increase the County’s investment in the Wake County Public School System’s operating budget by $40.3 million, which matches the Board of Education’s funding request, bringing the County’s total investment in the school district’s operations to $742.9 million.

https://www.wake.gov/departments-government/tax-administration/tax-bill-help/2025-property-tax-bills

Find My Branch GFL Environmental

To find your local phone number, hours of operation, and holiday schedule, enter your address below. You will also be asked to confirm the service type you require. Please select one of the following service types to provide the appropriate contact information. Click here to view all of our locations.

https://gflenv.com/find-my-branch/

Taxes Wake County Economic Development

2025 County and Municipal Property Tax Rates: Local property tax rates are calculated against each $100 in value. If you live in a city or town, you will pay both county and municipal property taxes, plus any additional special taxes that apply.

https://raleigh-wake.org/invest-expand-thrive/taxes

2026 Wake County Sales Tax Rate - Avalara

Wake County sales tax details The minimum combined 2026 sales tax rate for Wake County, North Carolina is 7.25%. This is the total of state, county, and city sales tax rates. The North Carolina sales tax rate is currently 4.75%. The Wake County sales tax rate is 2.0%.

https://www.avalara.com/taxrates/en/state-rates/north-carolina/counties/wake-county.html

Where can I pay property taxes? Town of Zebulon, NC

Wake County property taxes can be paid locally at the Wake County Eastern Regional Center located at 1002 Dogwood Drive in Zebulon. You can also pay online here: Pay Wake County Taxes. Vehicle taxes may be paid in person at the new location in Zebulon - 520 W.

https://www.townofzebulon.org/faq/where-can-i-pay-property-taxes

GIS Town of Wake Forest, NC

The Town of Wake Forest uses a GIS to maintain geographic information which can be analyzed to help answer questions and plan for future development. The GIS helps staff more efficiently complete tasks from those as simple as answering residents' questions, to the more complex task of developing a plan for managing a balance among land development, infrastructure, and natural resources as our Town grows.

https://www.wakeforestnc.gov/gis

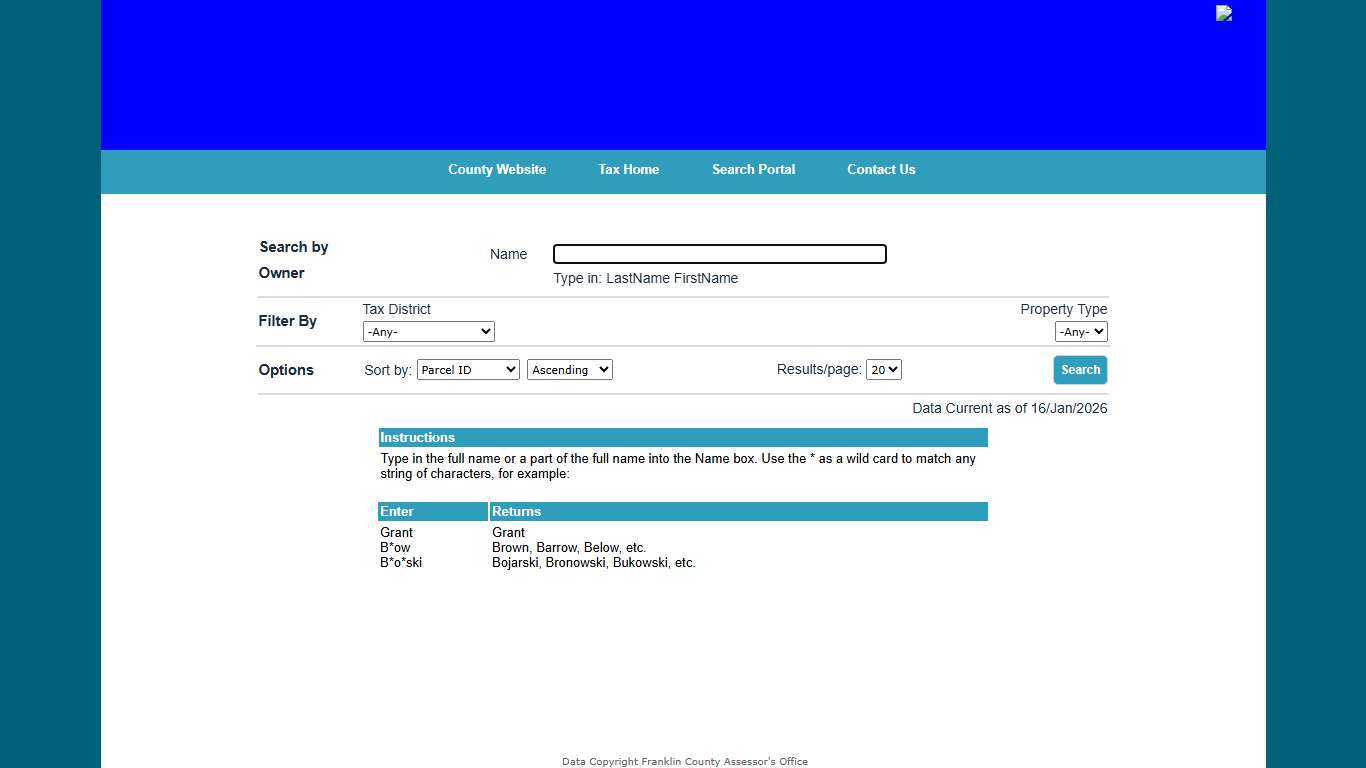

Franklin County Public Access - Owner Search

Type in: LastName FirstName. Filter By. Tax District, Property Type. -Any ... Last Updated: 16/Jan/2026. Powered by iasWorld Public Access. All rights ...

https://www.franklincountytax.us/search/commonsearch.aspx?mode=owner